can you go to jail for not paying taxes in south africa

This is because these violations are classed as a federal crime and classified as a. Tax fraud and evasion are the two tax crimes that can lead to a prison sentence.

Imprisonment Is Expensive Breaking Down The Costs And Impacts Globally Penal Reform International

You can go to jail for cheating on your taxes but not because you owe some money and cant pay.

. Any action taken to evade the assessment of a tax such as filing a fraudulent return can land you in prison for 5 years. You can go to jail if you lied on your tax return or didnt file one. Oftentimes youll be subject to tax penalties which will run you a pretty penny at up to 50 of your unpaid tax amount.

If you are making money that you are not paying taxes on the government will find out. For these people the answer to Can you go to jail for not paying taxes is No The IRS is in the business of collecting revenue rather than trying to punish people who make. However failing to pay your taxes doesnt automatically warrant a jail sentence.

Criminal charges can only be filed if you engage in tax evasion when you break the law to avoid paying taxes including. It is possible to go to jail for not paying taxes. However your actions must be willful and intentional which means you will not be.

For example unpaid child support or taxes might send you to prison for up to six months. In any case I will call attention to that while the Canada Revenue Agency CRA wont put you in prison their. Prison is a possibility as a penalty for not paying taxes - thats how gangster Al Capone ended up in prison.

I dont think anyone will go jail for not paying taxes but can for evasion of taxes. Whether a person would actually go to jail for not paying their taxes depends upon all. It is one thing if you owe and cant pay up.

The short answer is maybe. Preparing evidence is a must. The failure-to-pay penalty is 05 of your.

It would take a lot for the IRS to put you. If you file your tax return more than 60 days late the minimum failure-to-file penalty will be 100 of your unpaid taxes or 210 whichever is smaller. You may even face wage garnishment or property seizure.

Failure to File a Return. Your first step is to show why you didnt pay. However you will not go to jail for not paying your taxes.

Another way to find yourself in prison for not paying taxes is to not file a tax return at all. And you can get one year in prison for each year you dont file a return. The short answer is yes you can go to jail for not paying taxes.

The question can you go to jail for not filing taxes is complicated and multifaceted. Police will not be. Tax evasion is when you evade use trickery to avoid paying or.

The short answer to the question of whether you can go to jail for not paying taxes is yes. The kind of loan that you owe determines if you will go to jail for not paying it or not. Failing to file a return can land you in jail for one year for each year you didnt file.

Another entirely to engage in fraud to misrepresent the true state of. If you refuse to pay your taxes or child support for instance you might be sent to jail. In particular for not documenting you pay taxes no.

If criminal charges are filed for tax. If you do file a return but arent. To put it as simply as possible you can be arrested for not paying your taxes not a jail term.

But only if you did so on purpose. The short answer is yes. Tax Crimes That Can Lead to Jail Time.

Although it is very unlikely for an individual to receive a jail sentence for. Yes You Can Go To Jail For Past.

Irs Audit Penalties And Consequences Polston Tax

Is Not Paying Overtime Illegal In The U S Hourly Inc

12 Years Ago Today Donald Rumsfeld Sent The Greatest Memo Of All Time All About Time Teaching Writing Memo

19 Tax Evasion Statistics You Shouldn T Evade In 2021 Spendmenot

Rip Nelson Mandela Celebs Pay Their Respects To The Late South African Leader On Twitter E Online Nelson Mandela Quotes Mandela Quotes Nelson Mandela

How To File Your Income Taxes In South Africa Expatica

What S The Cost Homeopathic Medicine Homeopathy Homeopathic

What Happens If You Don T File Taxes Can You Go To Jail For Not Filing Taxes Parade Entertainment Recipes Health Life Holidays

Is A Tax Preparer Liable For Mistakes

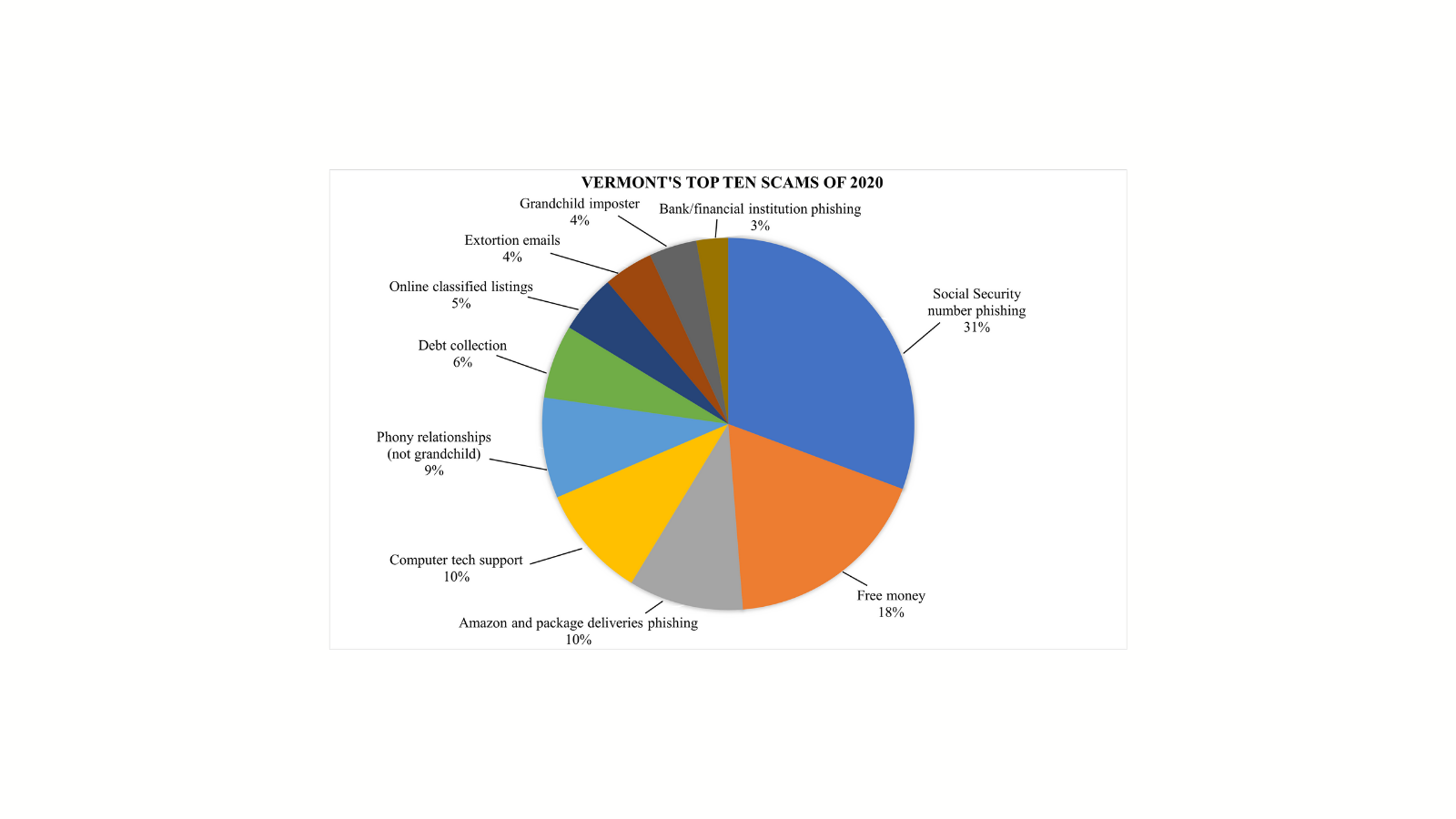

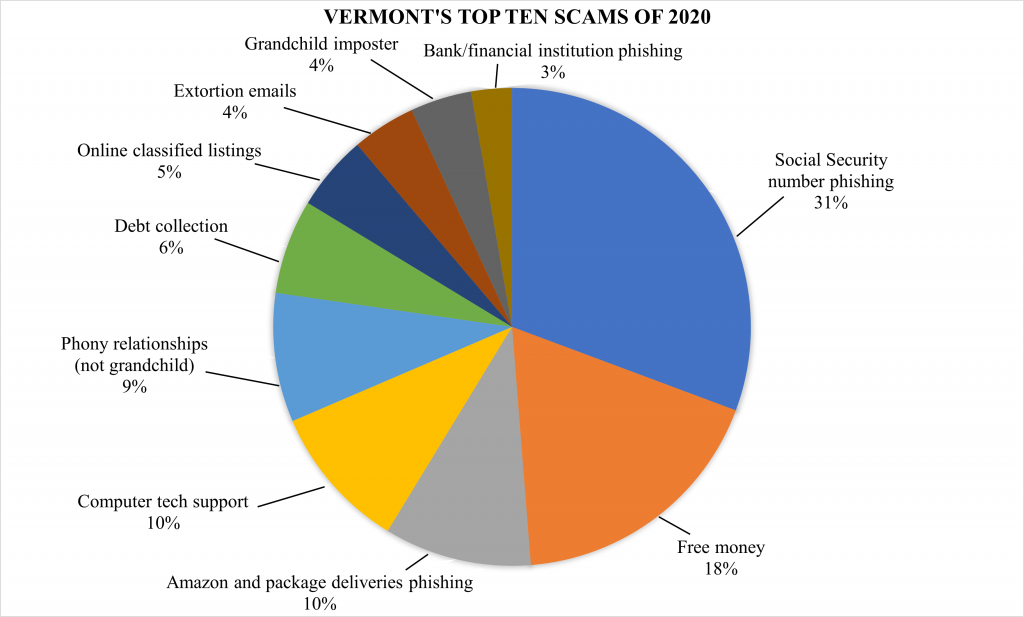

Top 10 Scams Of 2020 Released By Attorney General S Office Office Of The Vermont Attorney General

Review Better Not Bitter By Yusef Salaam Of The Central Park Five Npr

No It S Not Your Money Why Taxation Isn T Theft Tax Justice Network

How Far Back Can The Irs Go For Unfiled Taxes

Top 10 Scams Of 2020 Released By Attorney General S Office Office Of The Vermont Attorney General

Mental Health By The Numbers Nami National Alliance On Mental Illness

Identidad Digital Lytic2 Interroganteseducativos Special Needs Mom Tdcs Brain Stimulation

Money Mule Scams 101 What Can Banks Do To Prevent It Feedzai

/cloudfront-us-east-1.images.arcpublishing.com/gray/57XGVVQDFFH7TLUVIDZPLHUJZI.jpg)